41 zero coupon bond investopedia

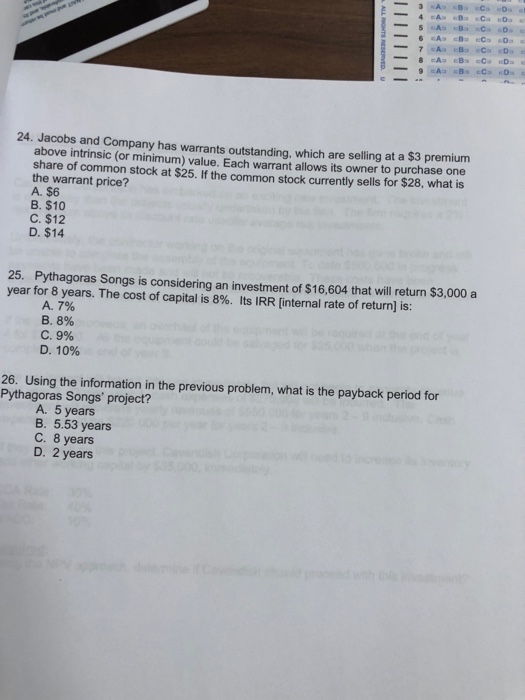

Zero Coupon Bonds - Porter Docs Zero Coupon Bonds A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. Deep Discount Bond Investopedia - Apr 2022 Deep Discount Bond Investopedia. Are you looking for "Deep Discount Bond Investopedia"? We collect results from multiple sources and sorted by user interest. You can easily access coupons about "Deep Discount Bond Investopedia" by clicking on the most relevant deal below.

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money Time Value of Money The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future..

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Zero coupon bond investopedia

What Is a Zero Coupon Yield Curve? (with picture) A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond. A contradictory concept on Convexity of Bonds? | Forum ... Thus we see that coupon bind on an average earned -8%+12%/2=2% whereas Z bond earned on average -9+15/2=3% on average thus Z Bond is more immune to losses that could arise by interest rate movement and always end on positive side of it anf thus overall interest rate affects negatively less the Z bond than coupon bonds. Investopedia Video: Zero-Coupon Bond : OptionsInvestopedia 1 vote and 0 comments so far on Reddit

Zero coupon bond investopedia. Investopedia Video: Zero-Coupon Bond | Lifestyle blog Investopedia Video: Zero-Coupon Bond December 2, 2018 December 2, 2018 Lifestyle Blog 0 Comments. Investopedia Video: Zero-Coupon Bond. A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. Investopedia Video: Zero-Coupon Bond - YouTube A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full fa... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for... "zero-coupon bond" là gì? Nghĩa của từ zero-coupon bond ... A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. Also known as an "accrual bond". Investopedia Says: Some zero-coupon bonds are issued as such, while others are bonds that have been stripped of their coupons by a financial ...

Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) Čo je to dlhopis s nulovým kupónom. Dlhopis s nulovým kupónom je dlhový cenný papier, ktorý neplatí úroky, ale namiesto toho obchoduje s hlbokou zľavou, ktorá vytvára zisk pri splatnosti, keď je dlhopis splatený za celú nominálnu hodnotu.1 Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... Investopedia - What is a Zero-Coupon Bond? | Facebook What is a Zero-Coupon Bond? Investopedia. July 28, 2017 · A coupon worth clipping? Related Videos. What are Zero coupon bonds? - INSIGHTSIAS What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank. These recapitalisation bonds are special types of bonds issued by the Central government specifically to a particular institution.

Special Zero Coupon Recapitalisation Bonds Zero-Coupon Bond, also known as the pure discount bond or deep discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. The difference between the purchase price of a zero coupon bond and the par value at the time of maturity, indicates the investor's return. Bootstrapping | How to Construct a Zero Coupon Yield Curve ... Zero-coupon rate for 2 year = 3.5% + (5% - 3.5%)* (2- 1)/ (3 - 1) = 3.5% + 0.75% Zero-Coupon Rate for 2 Years = 4.25% Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25% Conclusion The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. Zero Coupon Bond Definition Investopedia Nike Store Coupon November 2012 You shall not i select or use as a zero coupon bond definition investopedia User ID a name of another person with the intent to impersonate that person; ii use as a User ID a name subject to any rights of a person other than you without appropriate authorization; or iii use as a User ID a name that is otherwise ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

Bootstrapping (finance) - Wikipedia In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.. A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve.

The Macaulay Duration of a Zero-Coupon Bond in Excel Simply put, it is a type of fixed-income security that does not pay interest on the principal amount. To compensate for the lack of coupon payment, a zero-coupon bond typically trades at a discount, enabling traders and investors to profit at its maturity date, when the bond is redeemed at its face value. The Formula for Macaulay Duration

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Investopedia Video: Zero-Coupon Bond : OptionsInvestopedia 1 vote and 0 comments so far on Reddit

A zero-coupon bond is a discounted investment that can help you save for a specific future goal

A contradictory concept on Convexity of Bonds? | Forum ... Thus we see that coupon bind on an average earned -8%+12%/2=2% whereas Z bond earned on average -9+15/2=3% on average thus Z Bond is more immune to losses that could arise by interest rate movement and always end on positive side of it anf thus overall interest rate affects negatively less the Z bond than coupon bonds.

What Is a Zero Coupon Yield Curve? (with picture) A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "41 zero coupon bond investopedia"