40 coupon rate treasury bond

US Treasury Bonds - Fidelity US Treasury bonds: $1,000: Coupon: 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) ... (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Other ... Who sets the coupon rate for treasury bonds? - reddit Indian Treasury Bonds. India is offering 5.988% yield in 5-yr treasury bonds at discount 98 30/32. The Indian economy continues to flourish and by 2030 could surpass Japan in growth. So they look relatively stable.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Coupon rate treasury bond

What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): Take a look at the following picture: That's a copy of the famous Imperial Chinese Government 1911 Hukuang Railway Gold Bond. See those things on the right-hand side? They're coupons. This is a 5% bond that paid interest semi-annually (i.e., twice a year). Since this is a GBP 1... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Treasury Bonds | AOFM Treasury Bonds are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security, payable semi-annually. Indicative yields for Treasury Bonds are published by the Reserve Bank of Australia. Treasury Bonds on issue as at 20 May 2022. This table is updated weekly.

Coupon rate treasury bond. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Important Differences Between Coupon and Yield to Maturity A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for ... Treasury Bonds: Are They a Good Retirement Investment? The high yield, or auction rate, is 3.18%, so these bonds will sell at a discount to par. 20-year Treasury bills issued on May 31, 2022 have a coupon rate of $2.50% and a high yield of 3.29%, so ...

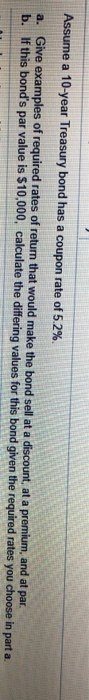

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. ... Interest Coupon Rate Price Explanation; Discount (price below par) 30-year bond Issue Date: 8/15/2005: 4.35%: 4.25%: 98.333317: MBS Live Morning: READ THIS!!! New Rules For Choosing an MBS Coupon Now chew on this fresh example: From 8:11am to 8:50am ET this morning, the bid/ask spread on 4.0 and 4.5 coupons moved in a range from 0.06 to .375. Over the same time frame, 5.0 coupon bid/ask ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

U.S. Treasury Bond Futures Quotes - CME Group Discover a streamlined approach to trading interest rate markets with Micro Treasury Yield futures, contracts based directly on yields of the most recently auctioned Treasury securities at key tenor points across the curve. ... U.S. Treasury Bond Yield Curve Analytics ... volatility, auctions, coupon issuance projections, and more. STIR ... Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. These instalments are called ... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . Fixing of coupon rates - Nykredit Realkredit A/S To Nasdaq Copenhagen 16 June 2022 FIXING OF COUPON RATES Fixing of coupon rates effective from 20 June 2022 Effective from 20 June 2022, the coupon rates of floating-rate bonds issued by Nykredit ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

Coupon Rate Formula | Step by Step Calculation (with Examples) The term " coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more " refers to the rate of interest paid to the ...

Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ...

Individual - Series I Savings Bonds - TreasuryDirect Rates & Terms. I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. ... The coupon rate can vary depending upon the structure of the ...

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face ...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Treasury Bonds Rates - WealthTrust Securities Limited A Treasury Bond (T-Bond) is a zero default-risk, extremely liquid medium to long term debt instrument issued by the CBSL which consists of maturity period ranging from 2 to 25 years with semiannual coupon payments. ... Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium ...

Coupon Rate Structure of Bonds — Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years.

Treasury Bonds | AOFM Treasury Bonds are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security, payable semi-annually. Indicative yields for Treasury Bonds are published by the Reserve Bank of Australia. Treasury Bonds on issue as at 20 May 2022. This table is updated weekly.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): Take a look at the following picture: That's a copy of the famous Imperial Chinese Government 1911 Hukuang Railway Gold Bond. See those things on the right-hand side? They're coupons. This is a 5% bond that paid interest semi-annually (i.e., twice a year). Since this is a GBP 1...

Post a Comment for "40 coupon rate treasury bond"