44 advantage of zero coupon bond

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Nov 25, 2020, 10:09 AM. Save Article Icon. A bookmark. Facebook Icon. The letter F ... The Zero Coupon Bond: Pricing and Charactertistics "Zero Coupon Bond" or "Strip Bond" are bonds that are created by "stripping" a normal bond into its constituent parts: the "Coupons" and "Residual" or "Resid". An investment dealer will first buy a bond and then "strip" it. The individual coupons are the semi-annual interest payments due on the bond prior to maturity.

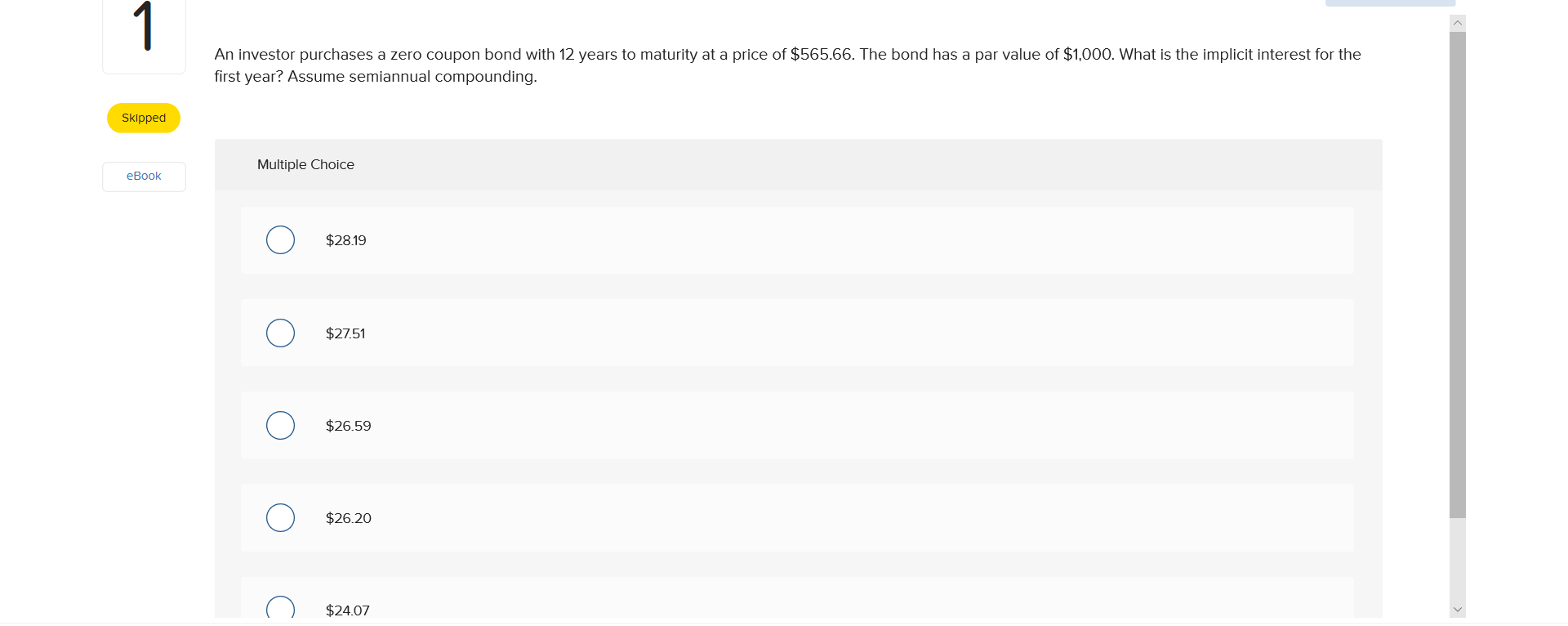

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

Advantage of zero coupon bond

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... You (or your spouse, if filing jointly) received health savings account, Archer MSA, or Medicare Advantage MSA distributions. 3. You had net earnings from self-employment of at least $400. 4. You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes. 5. Zero Coupon Bonds - Taxation, Advantages & Disadvantages This is because zero coupon bonds can help in securing a guaranteed return at the end of a fixed time period. Since these bonds offer discounts for longer investment tenures, they are ideal for those who have long-term investment plans. What are the benefits of investing in Zero-Coupon Bond? What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Advantage of zero coupon bond. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. › webhpGoogle Search the world's information, including webpages, images, videos and more. Google has many special features to help you find exactly what you're looking for. What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

The best advantage of a zero-coupon bond to the issuer is that the ... The best advantage of a zero-coupon bond to the issuer is that the. Bond requires a low issuance cost. Bond requires no interest income calculation to the holder or issuer until maturity. Interest can be amortized annually by the APR method and need not be shown as an interest expense to the issuer. Interest can be amortized annually on a ... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. Zero Coupon Bonds - Taxation, Advantages & Disadvantages The earnings from a zero-coupon bond are primarily the difference between the purchase price of the bond and the maturity value or face value. What is the duration of a zero-coupon bond? Duration in a zero-coupon bond is the time to maturity. Normally, these bonds come with a duration of 10 years or more. How to invest in zero coupon bonds? Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

The Pros and Cons of Zero-Coupon Bonds - Financial Web Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Funds zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect forebear holdings at precisely the right time. The responsiveness of bond prices to interest rate changes increases with the schedule to maturity and decreases with interest payments. Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Advantage of Zero-Coupon Bonds. From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. Therefore, in case of longer time duration (a higher ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

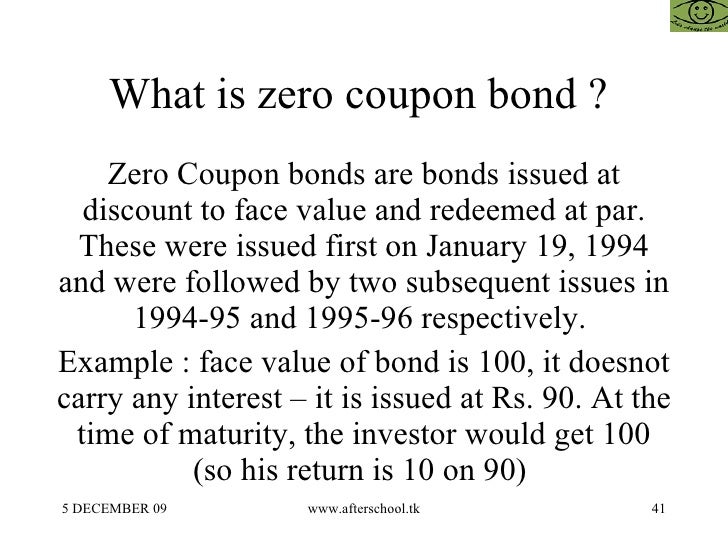

What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia What is a Zero-Coupon Bond? Zero-coupon bond or ZCB is a financial instrument that does not pay any interest or coupon rate but is, instead, issued at a deep discount and is redeemed at face value on maturity. The return earned by the investor is the difference between the issue price and the redemption price.

What Is The Advantage Of Investing In A Zero Coupon Bond Bonds with zero coupons are issued at a discount and redeemed at face value. On such bonds, no interest is paid at regular intervals before maturity. The price at which Zero Coupon Bonds are offered for purchase is substantially lower than the bond's face value. Thus, offering an investor an advantage to begin their investment at low valuations.

wiki.librivox.orgLibrivox wiki Jan 20, 2022 · LibriVox About. LibriVox is a hope, an experiment, and a question: can the net harness a bunch of volunteers to help bring books in the public domain to life through podcasting?

coursehelponline.comCourse Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

What is a zero-coupon bond? What are the advantages and risks? A zero coupon bond is a bond that pays no cash interest until maturity. All the interest accrues and is paid with the final principal payment. An advantage is that the rate of return on your investment is locked in when you buy it.

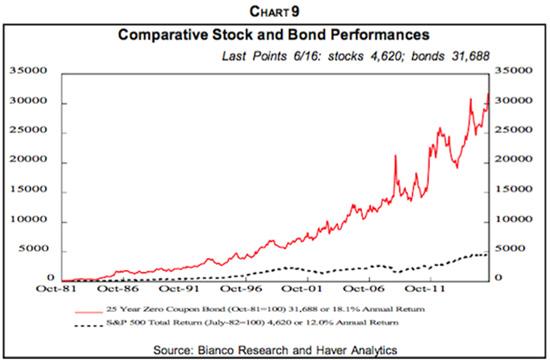

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The...

Zero Coupon Bond - Finschool By 5paisa Advantages Of Zero Coupon Bond. They often have higher interest rates than other bonds- Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them more attractive to investors. As a result, these bonds often come with higher yields than traditional bonds.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Since the Interest accrued is discounted from the Par value of such Bonds at purchase, which effectively enables Investors of Zero Coupon Bonds to buy a greater number of such bonds compared to any other Coupon Bearing Bond. Zero-Coupon Bond Formula we can calculate the Present value of using this below-mentioned formula:

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

en.wikipedia.org › wiki › ArbitrageArbitrage - Wikipedia The idea of using multiple discount rates obtained from zero-coupon bonds and discounting a similar bond's cash flow to find its price is derived from the yield curve, which is a curve of the yields of the same bond with different maturities. This curve can be used to view trends in market expectations of how interest rates will move in the future.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-Coupon Bond Definition - Investopedia Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1 A bond is a portal through which a corporate or governmental body...

recorder.butlercountyohio.org › search_records › subdivisionWelcome to Butler County Recorders Office Copy and paste this code into your website. Your Link Name

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon ...

What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages This is because zero coupon bonds can help in securing a guaranteed return at the end of a fixed time period. Since these bonds offer discounts for longer investment tenures, they are ideal for those who have long-term investment plans. What are the benefits of investing in Zero-Coupon Bond?

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... You (or your spouse, if filing jointly) received health savings account, Archer MSA, or Medicare Advantage MSA distributions. 3. You had net earnings from self-employment of at least $400. 4. You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes. 5.

Post a Comment for "44 advantage of zero coupon bond"