38 what is the coupon rate of a bond

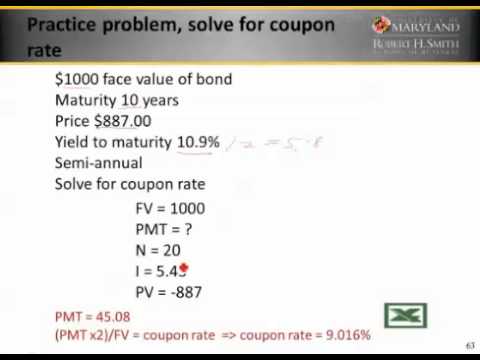

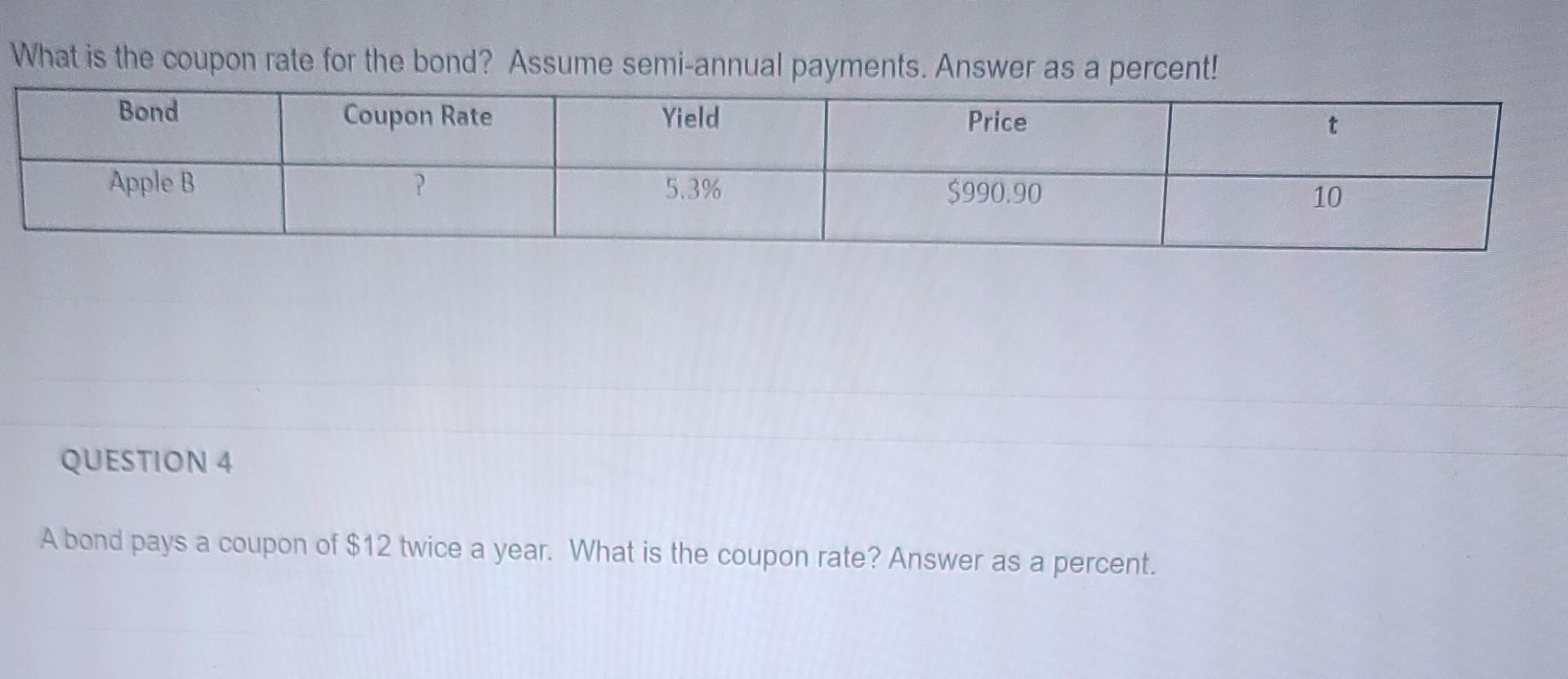

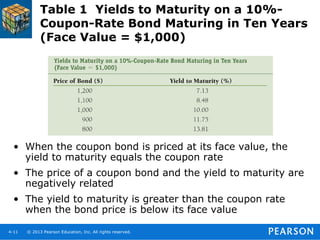

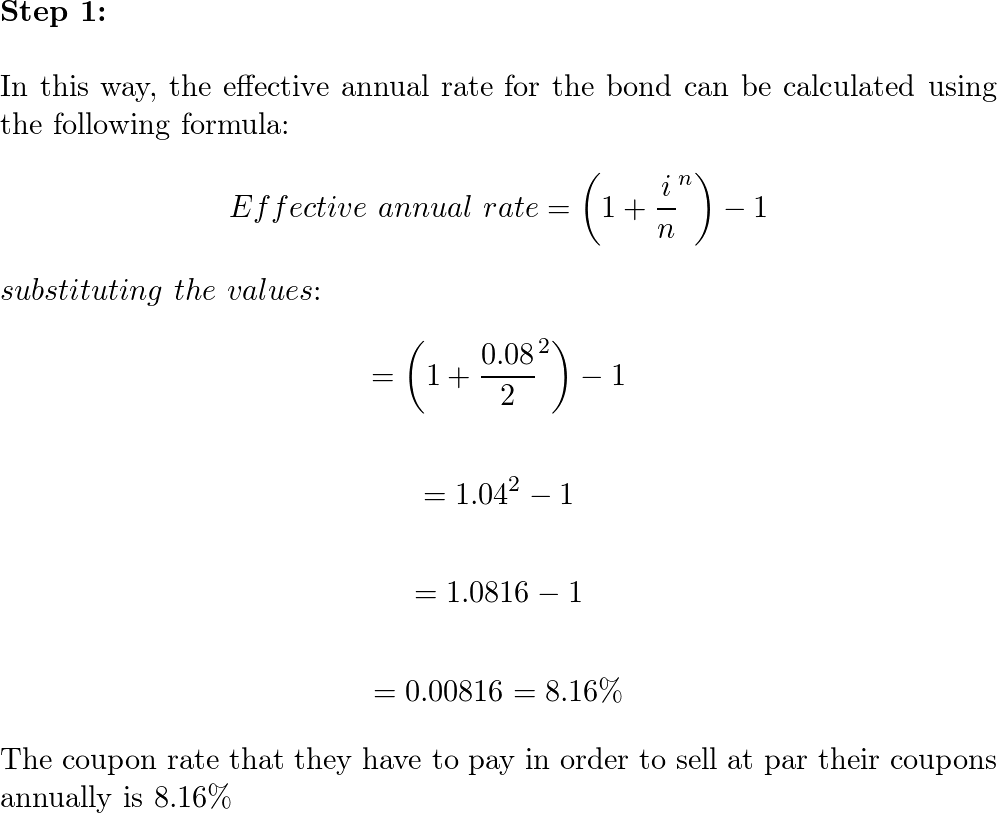

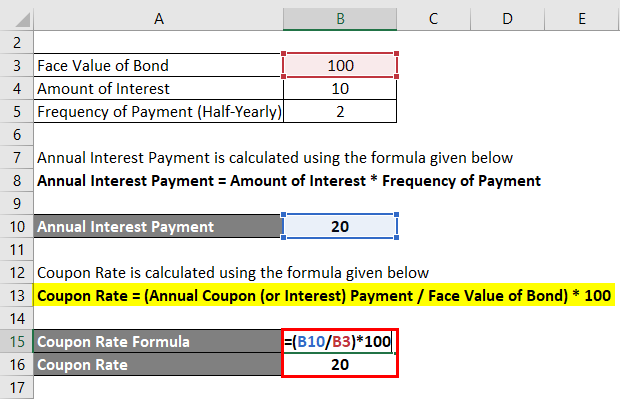

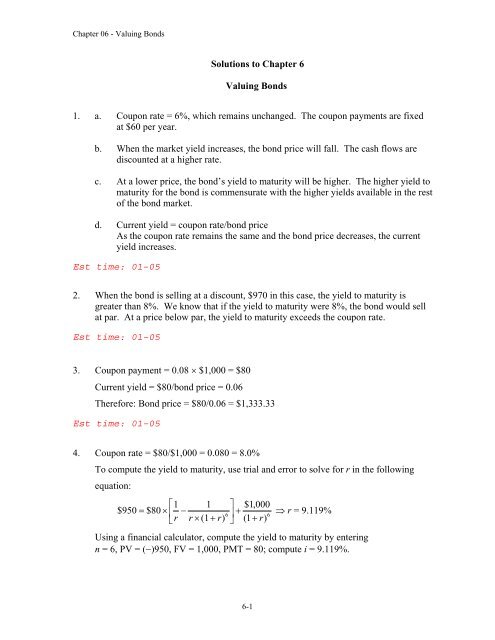

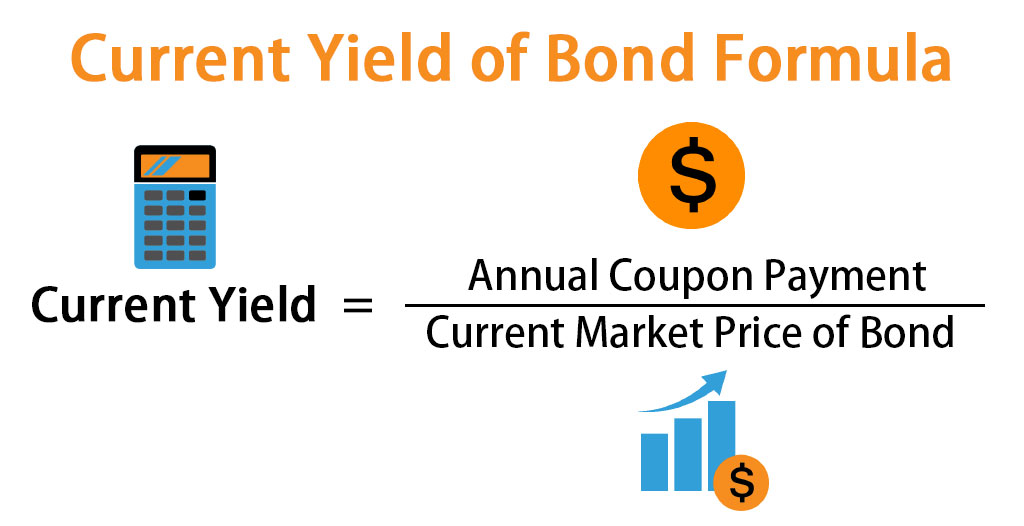

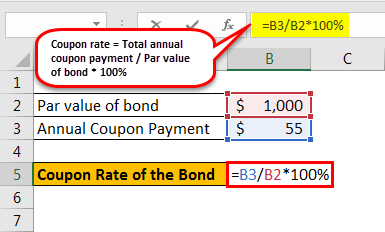

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What is the coupon rate of a bond

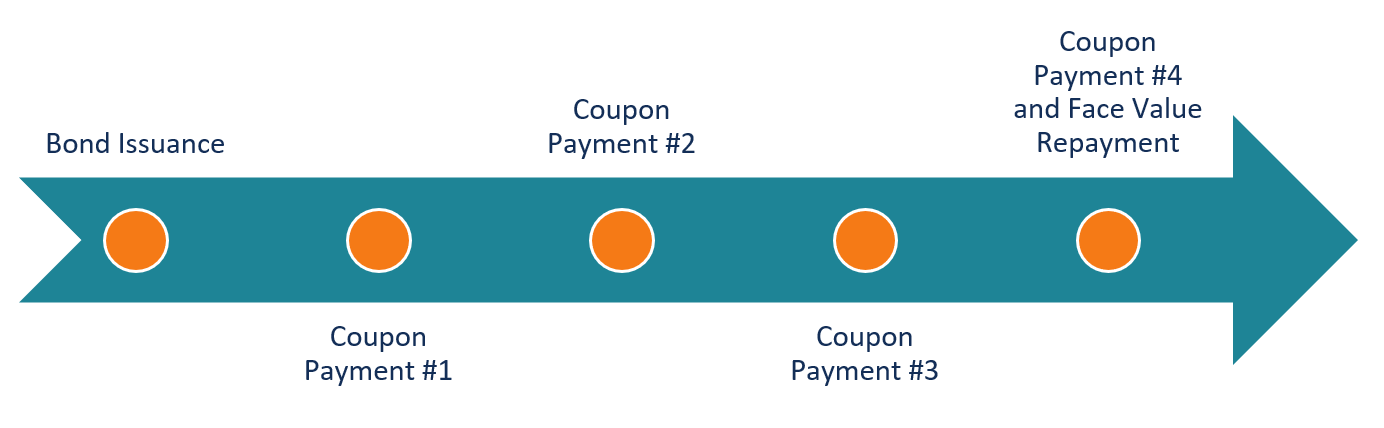

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... › what-is-a-bond-couponWhat Is a Bond Coupon? - The Balance Mar 04, 2021 · "Bond coupons" is a term that's used to refer to physical coupons. These coupons could be redeemed for cash. The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest ... › articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. Although a bond's coupon rate is fixed, the price of a bond sold in secondary markets can fluctuate.

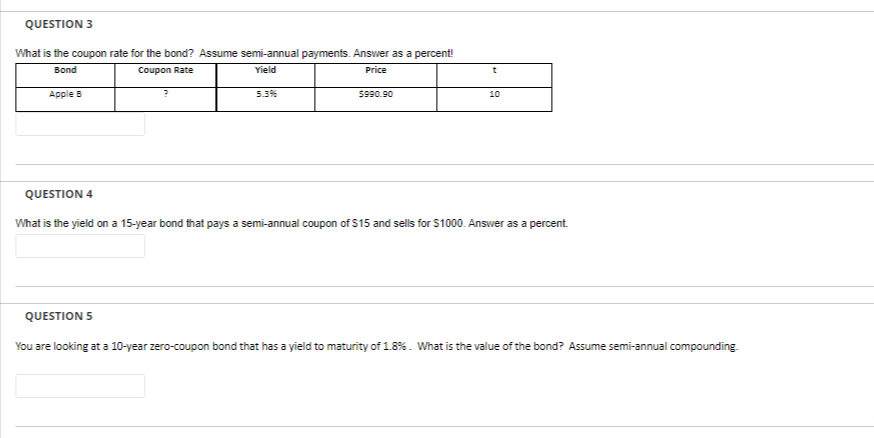

What is the coupon rate of a bond. Ομόλογο - Βικιπαίδεια Επιτόκιο Έκδοσης (coupon rate): Υπάρχουν ομόλογα σταθερού επιτοκίου (fixed rate bond), δηλαδή ομόλογα που πληρώνουν το ίδιο τοκομερίδιο σε όλη την διαρκή της ζωής τους, και ομόλογα μεταβλητού ή ... › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. Although a bond's coupon rate is fixed, the price of a bond sold in secondary markets can fluctuate. › what-is-a-bond-couponWhat Is a Bond Coupon? - The Balance Mar 04, 2021 · "Bond coupons" is a term that's used to refer to physical coupons. These coupons could be redeemed for cash. The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest ...

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

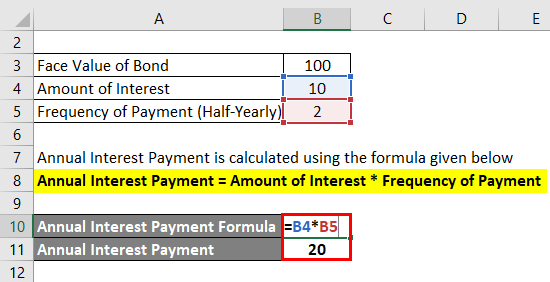

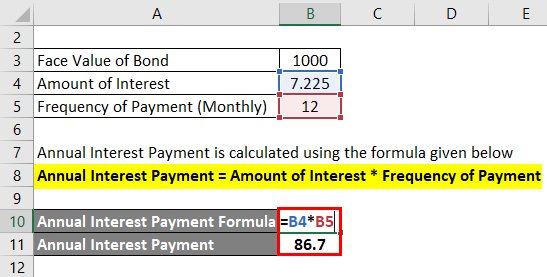

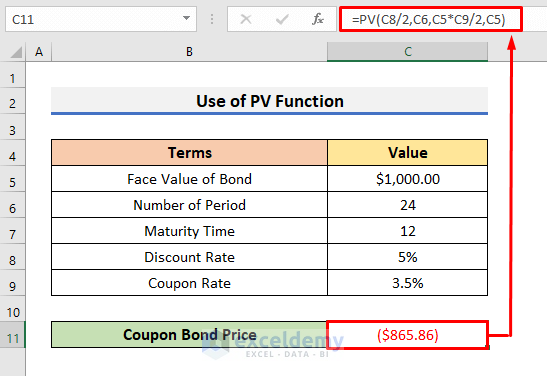

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 what is the coupon rate of a bond"