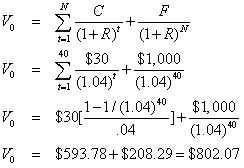

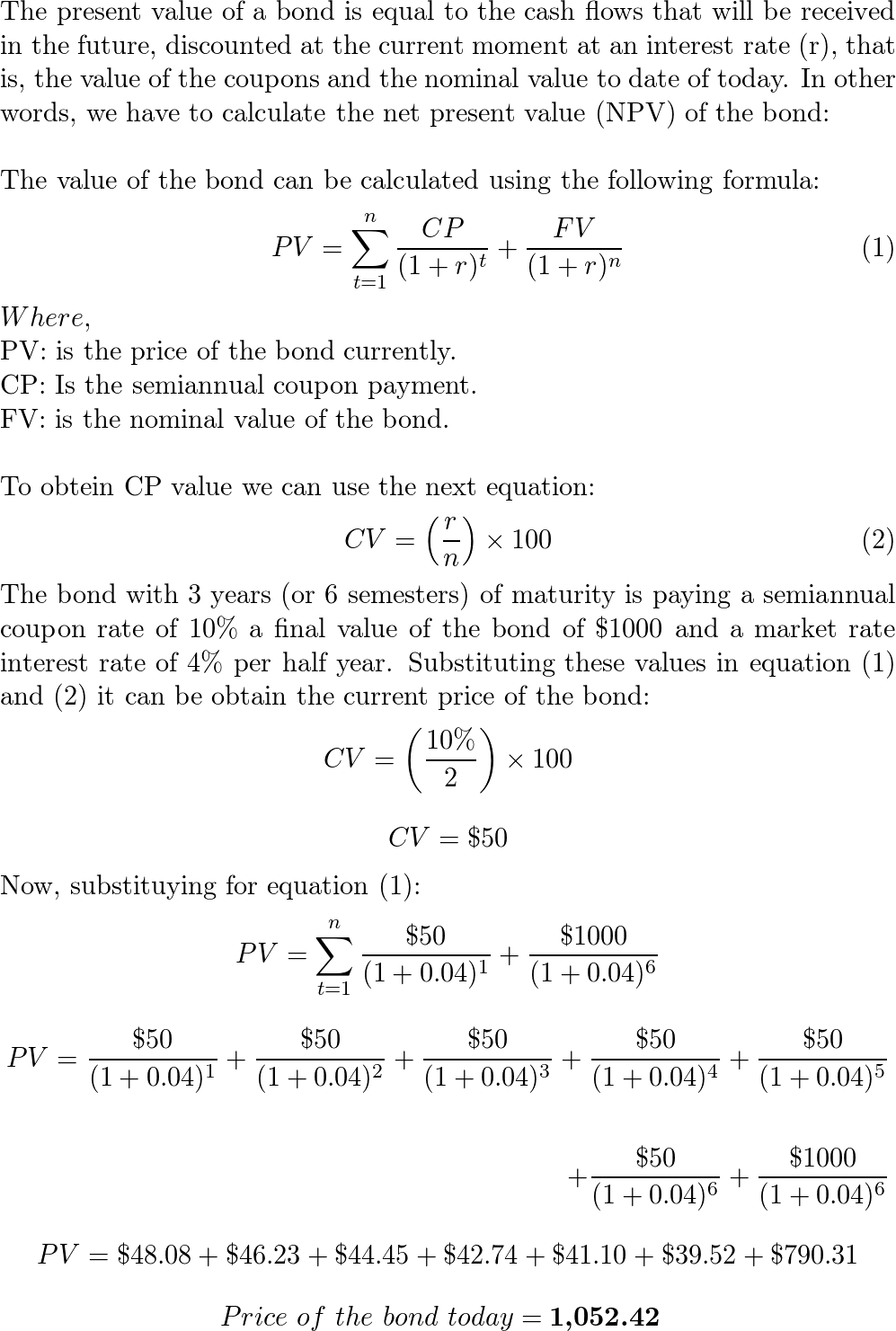

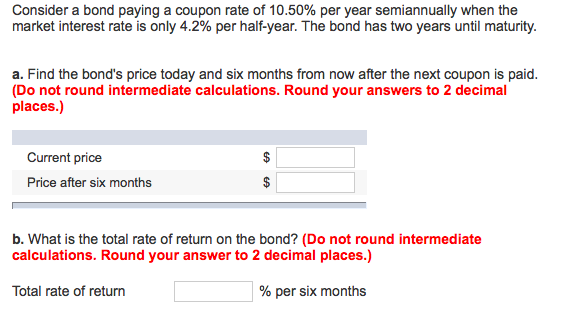

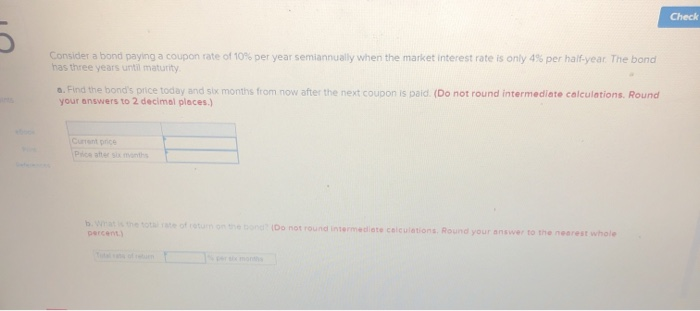

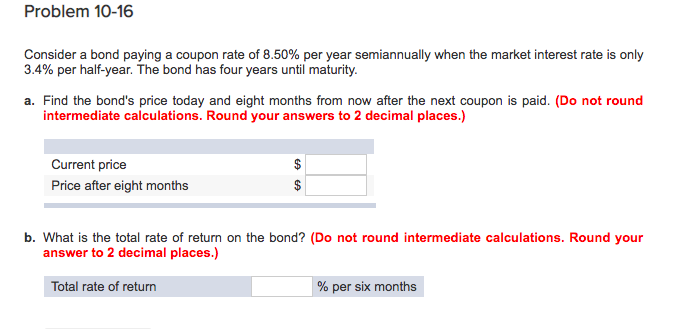

41 consider a bond paying a coupon rate of 10 per year semiannually when the market

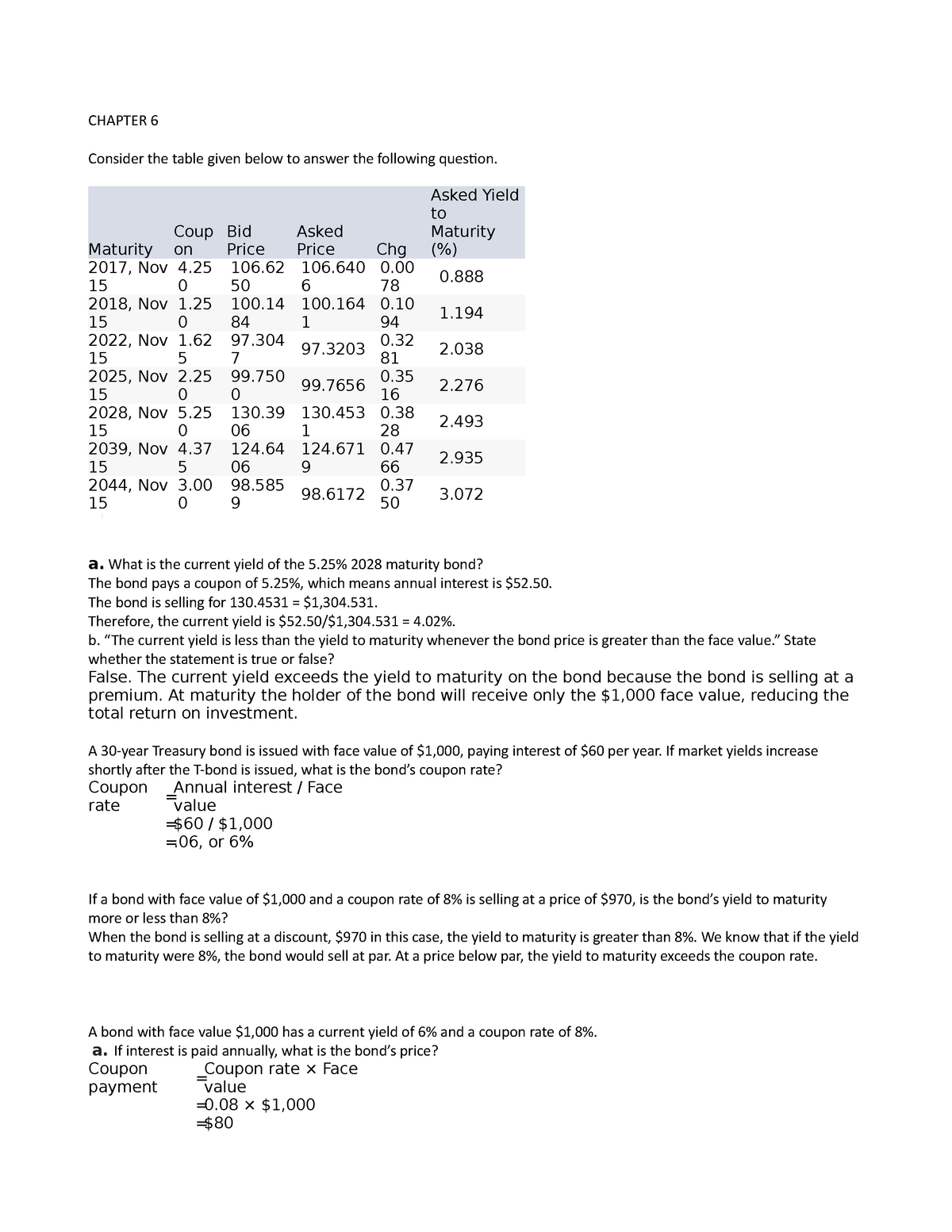

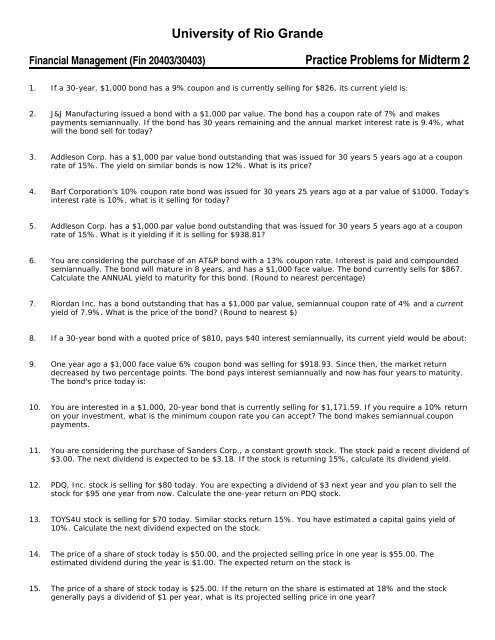

Guide to Fixed Income: Types and How to Invest - Investopedia 31/08/2022 · Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels. Fixed-income investments can be used to ... Treasury Bonds | CBK If the bond has a pre-determined coupon rate in the prospectus, you should choose Non-Competitive/Average Rate. If the prospectus says that the coupon rate is market determined, you can select either the Interest/Competitive Rate or the Non-Competitive/Average Rate. Investors choosing the Interest/Competitive Rate bid on the bonds by submitting ...

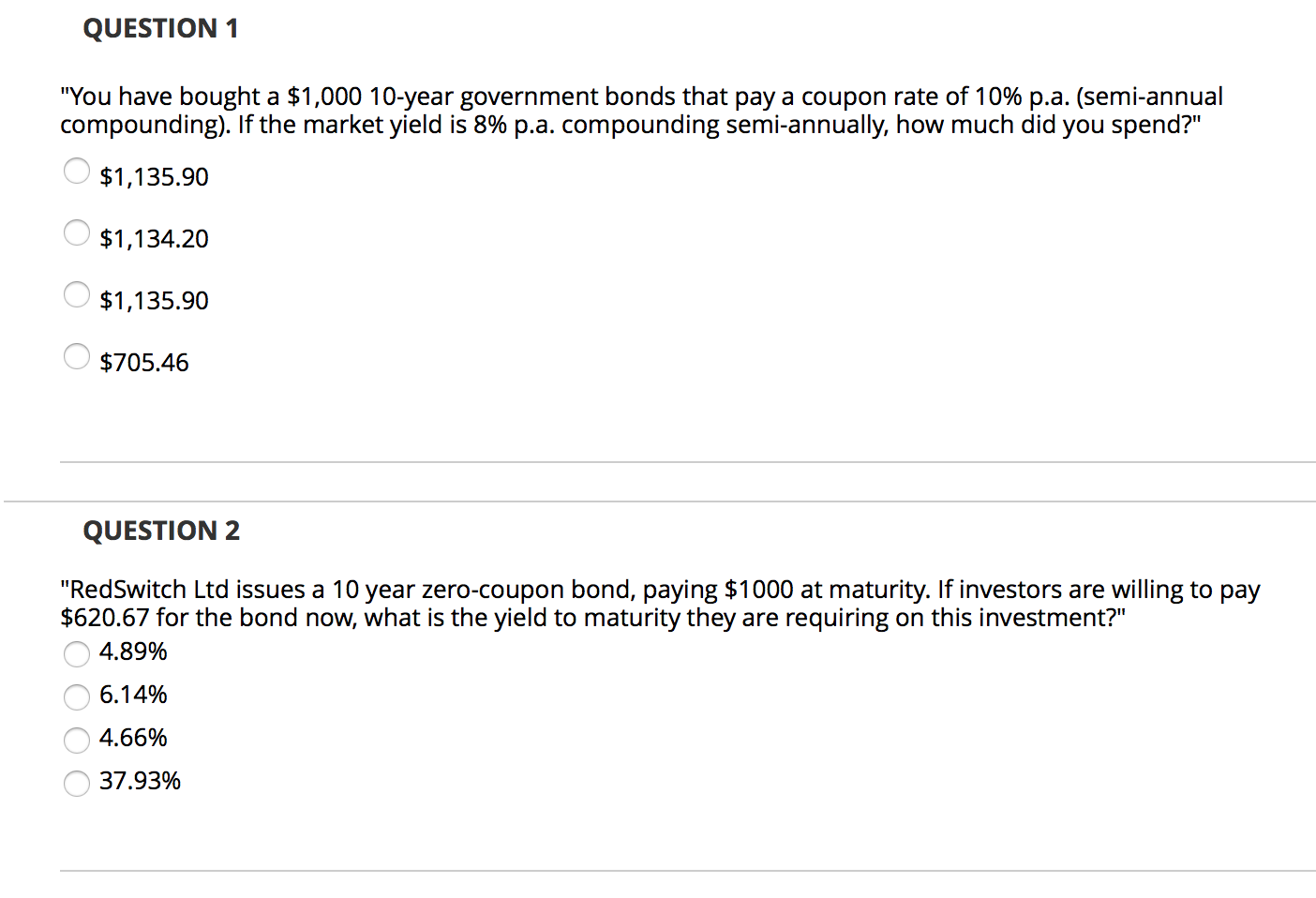

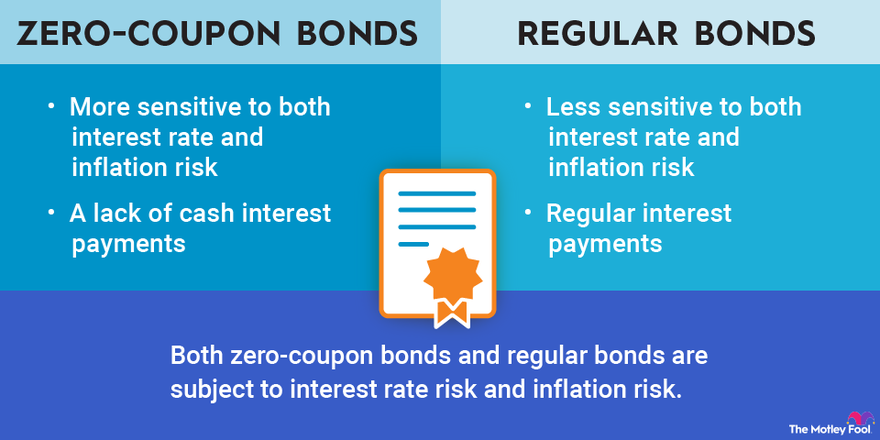

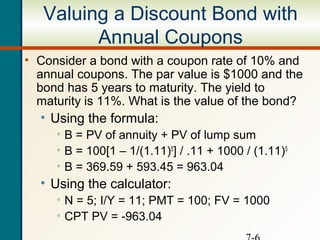

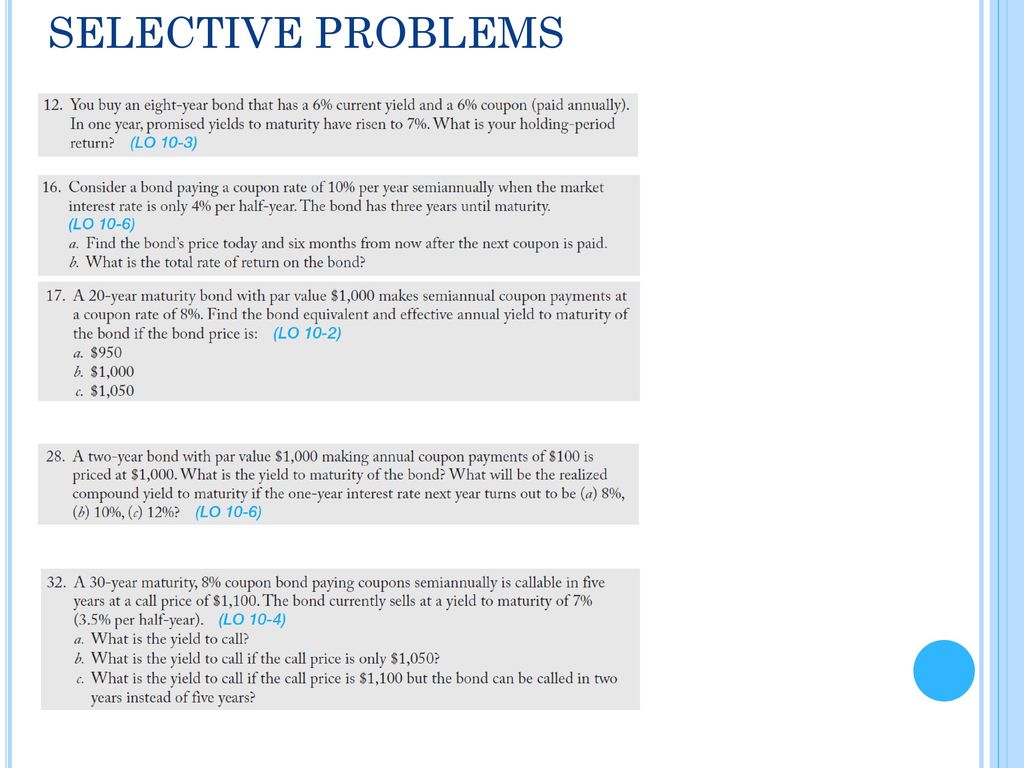

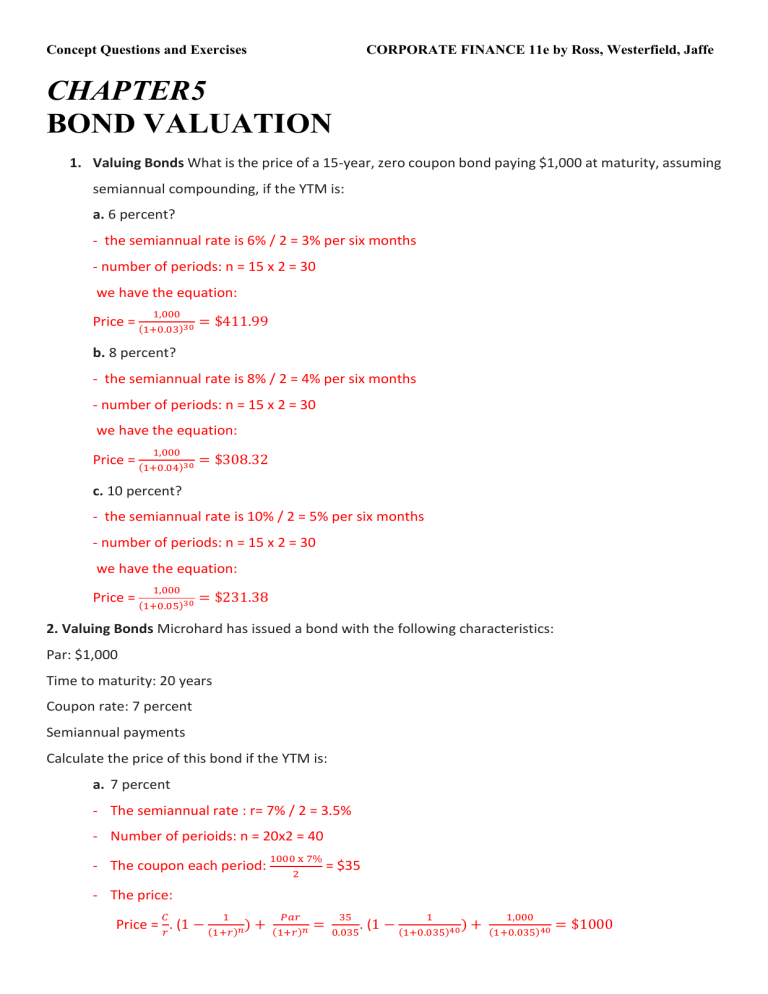

FNCE3050 Ch. 7 Valuing Bonds Flashcards | Quizlet You want to compute the value of a 5-year zero-coupon corporate bond given a market rate of 5.5 percent. Which of these represent correct calculator inputs? Select all that apply. N=10; FV=1,000 (The assumed par value of a corporate bond is $1,000) A 7.5 percent corporate bond matures in 16 years and has a price quote of 102.3. What is the yield to maturity? 7.2547 percent. A …

Consider a bond paying a coupon rate of 10 per year semiannually when the market

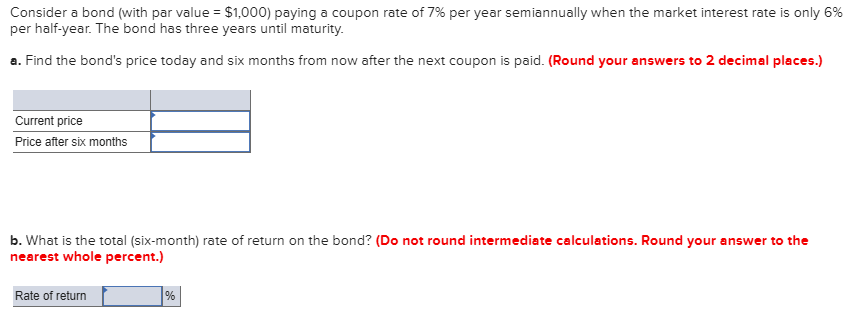

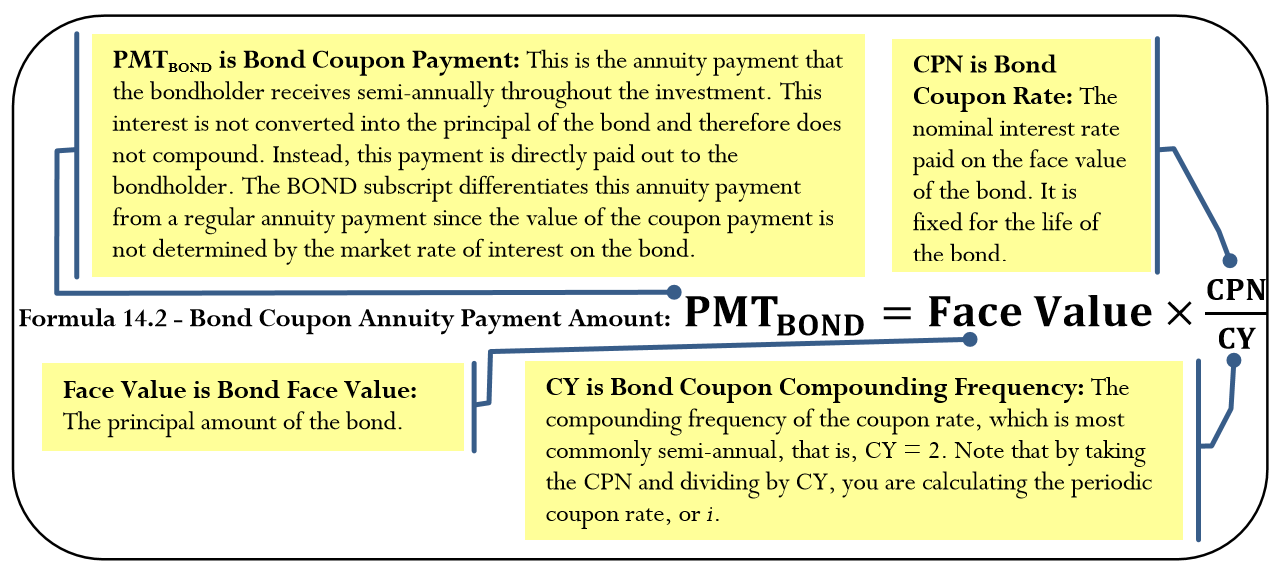

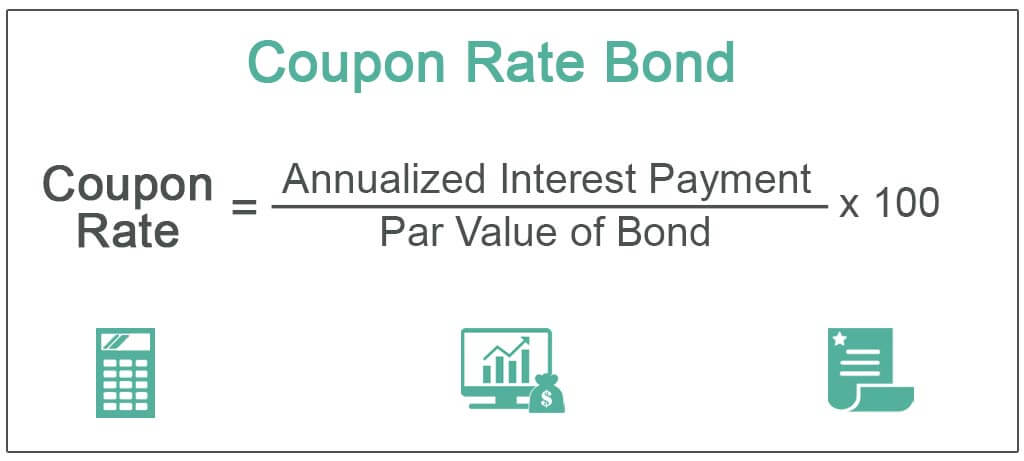

Bonds vs. Bond Funds: Which is Right for You? | Charles Schwab 24/01/2020 · Since bond mutual funds and ETFs own many securities, the impact of one bond default would likely be less than for an individual investor owning individual bonds. While some bond investments may be made in denominations as low as $1,000 per bond, the appropriate amount to invest is best determined by an individual's investing goals and objectives. The Ultimate Guide to Bonds - US News & World Report 07/05/2020 · Issuers use the bond's maturity and prevailing market interest rates to determine a competitive interest rate, called the coupon rate. It's expressed as an annual percentage of the face value. A ... How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow 19/04/2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid. For example, assume that the bond matures in ...

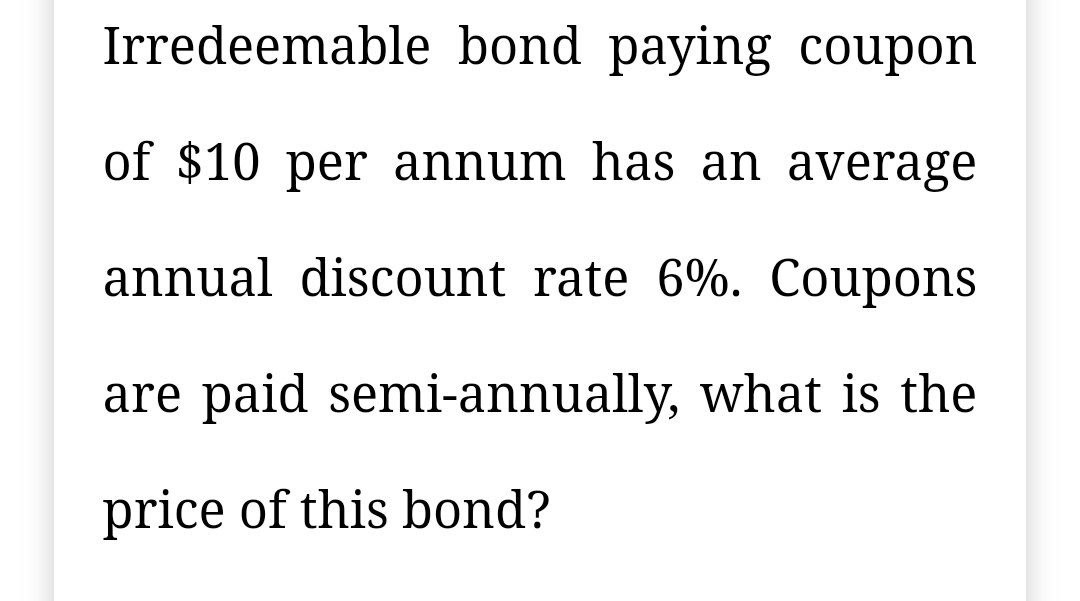

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Bus1-170 Exam 2 Flashcards | Quizlet Last year, the market interest rate was 10.0%, but it has increased to 12.0%. The amount of capital exchanged increased from $8.0 billion to $10.0 billion. Which of the following factors could be responsible for the change in demand shown in the graph? The Federal Reserve (the Fed) decided to relax its monetary policy and expanded the money supply. Households began … Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Interest - Wikipedia Compound interest includes interest earned on the interest that was previously accumulated. Compare, for example, a bond paying 6 percent semiannually (that is, coupons of 3 percent twice a year) with a certificate of deposit that pays 6 percent interest once a year.The total interest payment is $6 per $100 par value in both cases, but the holder of the semiannual bond receives … Pro Rata: What It Means and the Formula to Calculate It 18/07/2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow 19/04/2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid. For example, assume that the bond matures in ... The Ultimate Guide to Bonds - US News & World Report 07/05/2020 · Issuers use the bond's maturity and prevailing market interest rates to determine a competitive interest rate, called the coupon rate. It's expressed as an annual percentage of the face value. A ... Bonds vs. Bond Funds: Which is Right for You? | Charles Schwab 24/01/2020 · Since bond mutual funds and ETFs own many securities, the impact of one bond default would likely be less than for an individual investor owning individual bonds. While some bond investments may be made in denominations as low as $1,000 per bond, the appropriate amount to invest is best determined by an individual's investing goals and objectives.

Post a Comment for "41 consider a bond paying a coupon rate of 10 per year semiannually when the market"