45 zero coupon bond face value

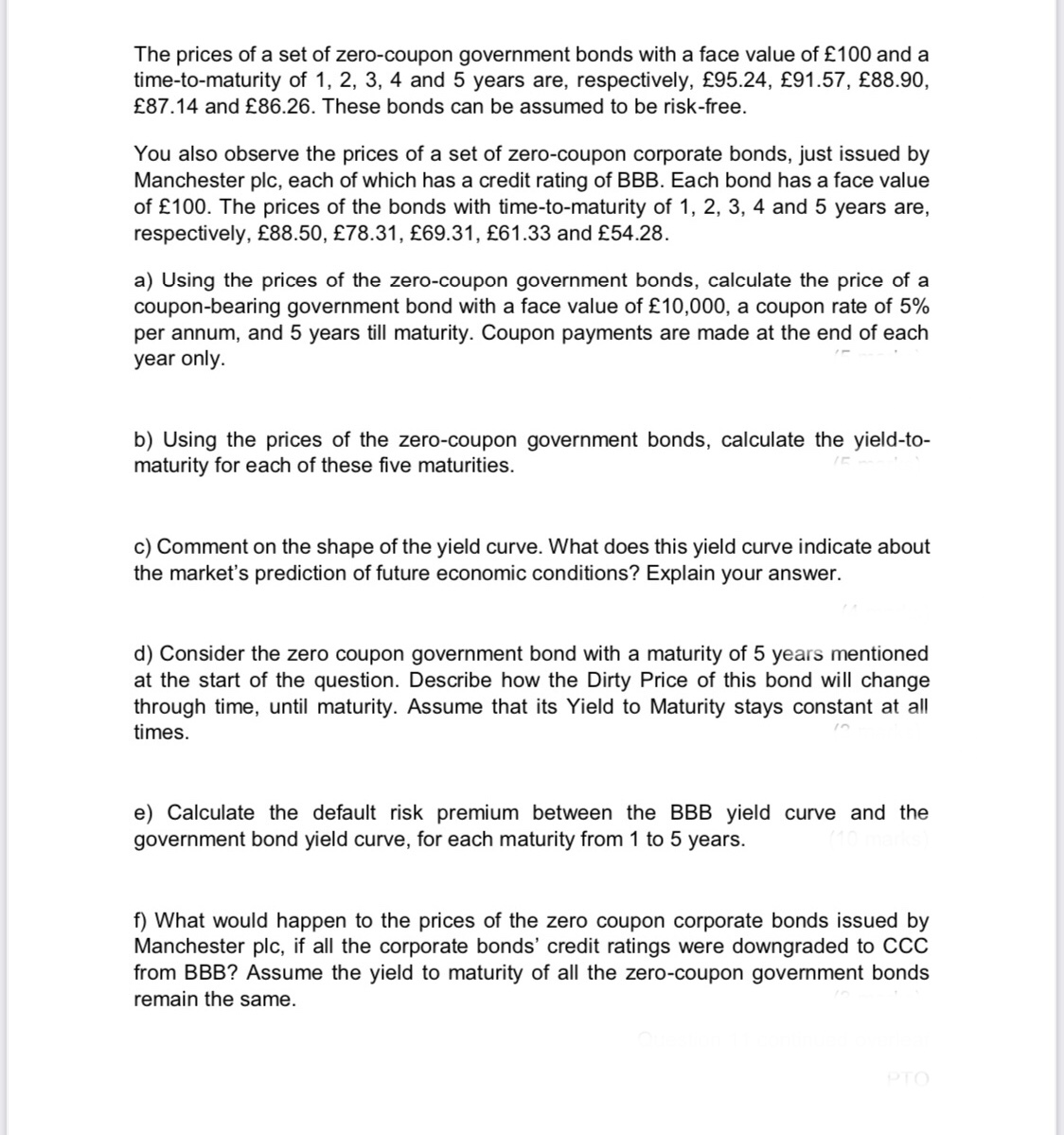

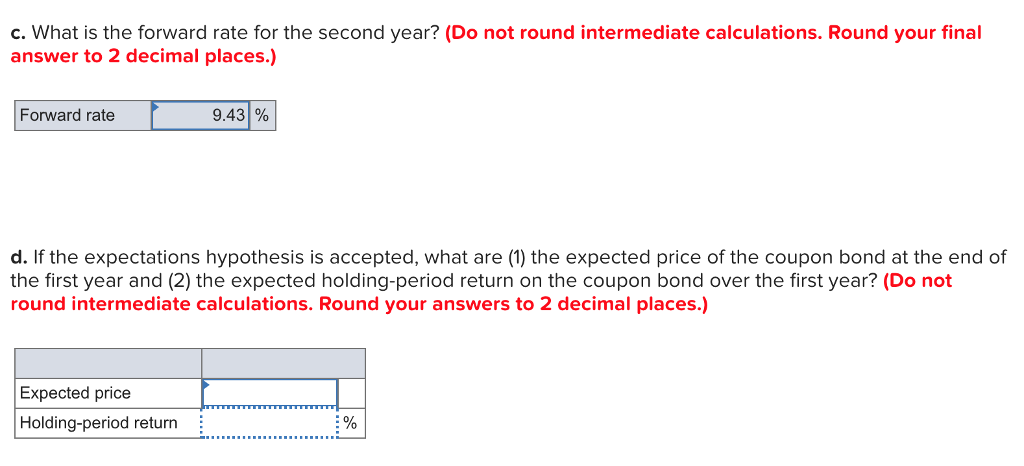

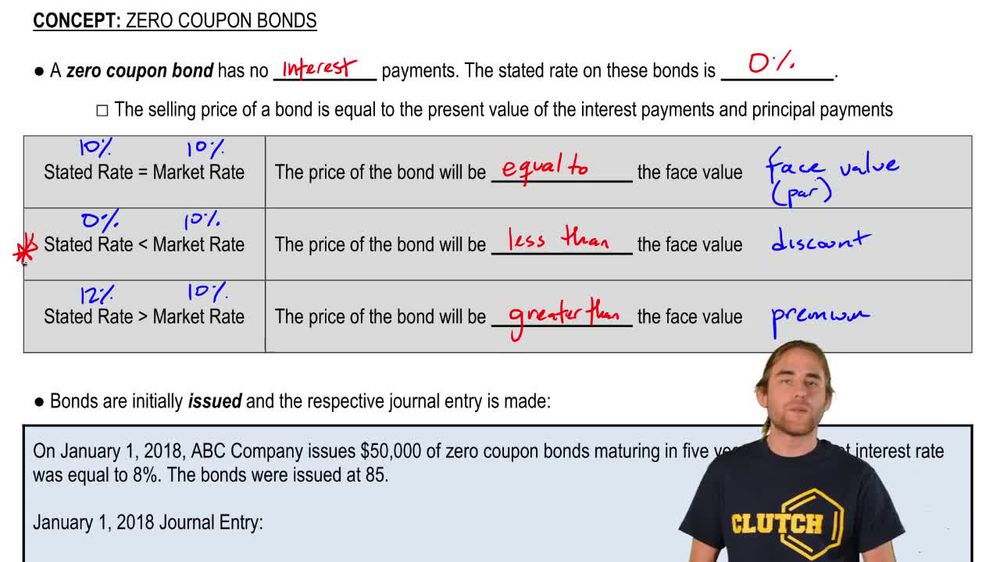

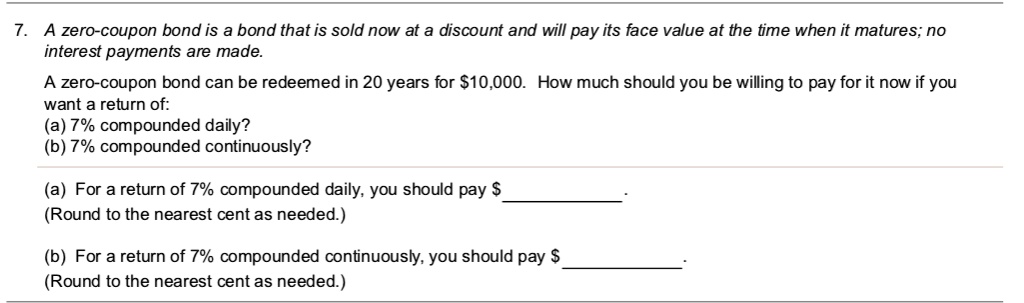

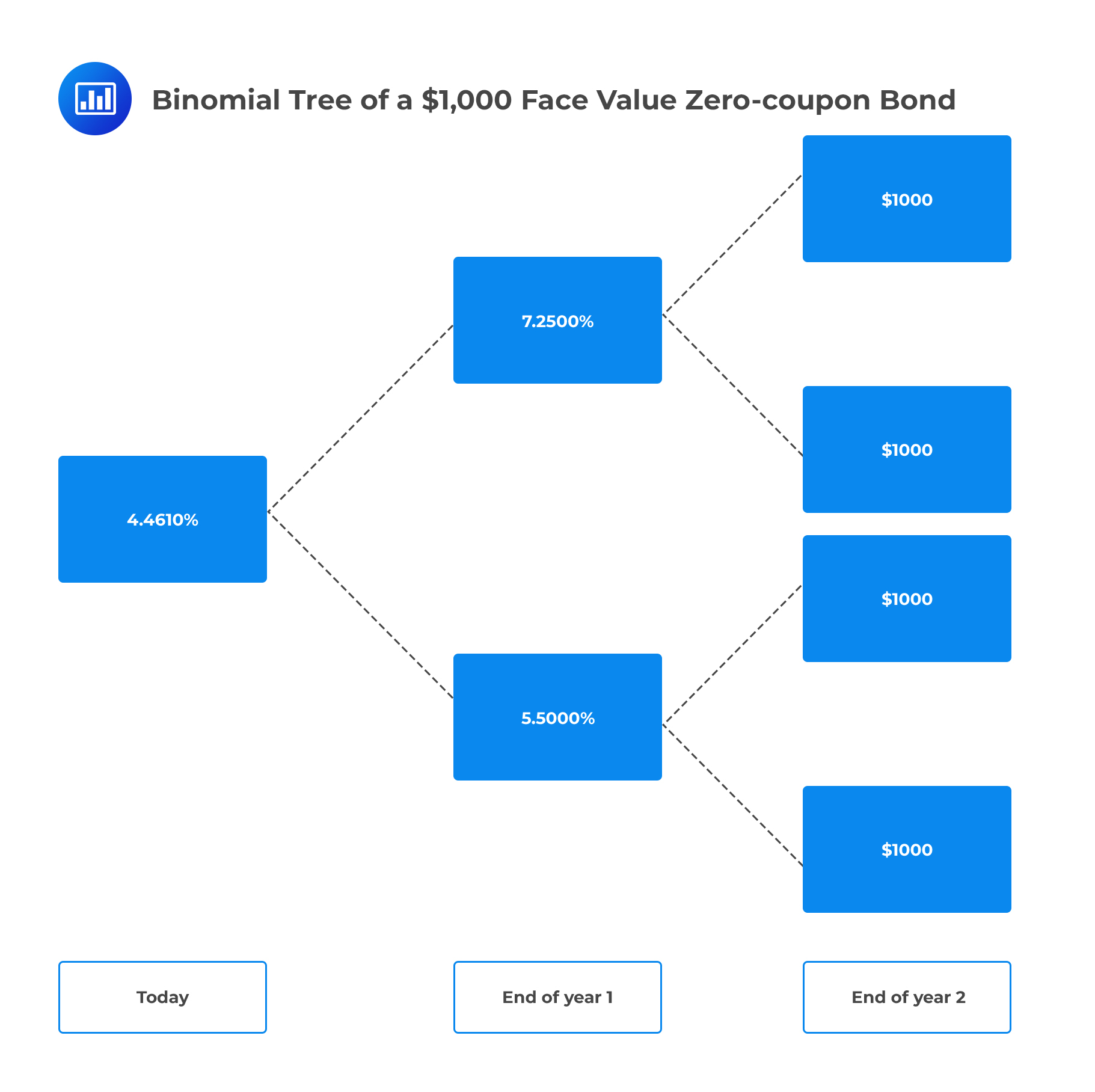

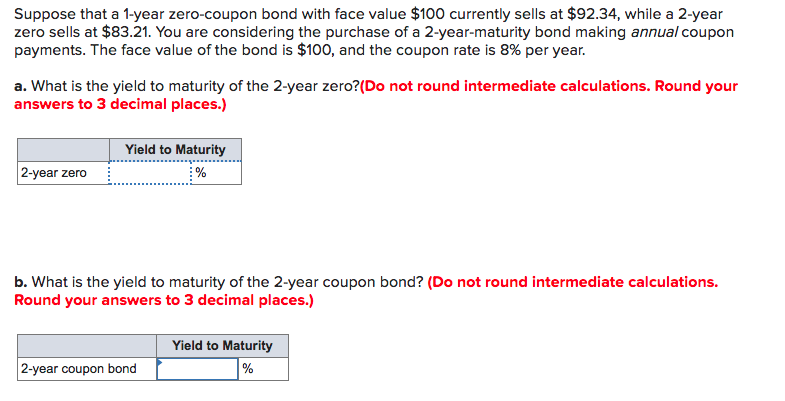

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia WebAug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia With no coupon payments on zero-coupon bonds, their value is entirely based on the current price compared to face value. As such, when interest rates are falling, prices are...

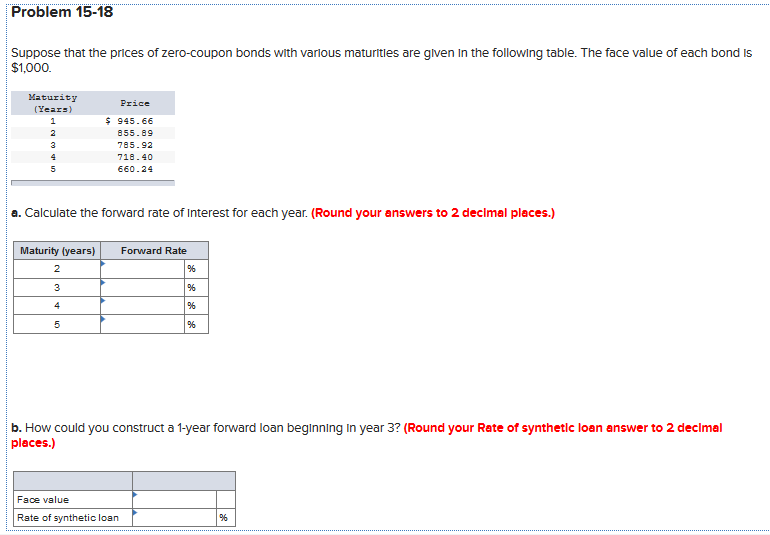

Solved Assume that a 1-year zero-coupon bond is issued with | Chegg.com Solution: A) Calculation of price of zero coupon bond: Value …. View the full answer. Assume that a 1-year zero-coupon bond is issued with a face value of $1,000 and the yield to maturity of 8.5%. What is the value of this zero-coupon bond and investor's profit when it matures? \$665; \$335 $1,000;$0 $922;$78 $834;$166.

Zero coupon bond face value

Solved 1. a.) A zero-coupon bond has a face value of $120.00 - Chegg A zero-coupon bond has a face value of $120.00 and matures in 3 years. The rate of return on equally risky assets is 5% (.05). What will its price be today? Suppose you sell it next year when the rate of return on equally risky assets is 4% (.04). What rate of return did you earn holding the asset for a year? b.) A stock is expected to pay an ... › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › zerocouponregularbondCoupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity.

Zero coupon bond face value. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Understanding Bond Prices and Yields - Investopedia WebJun 28, 2007 · If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be purchased for far less than half of that amount. Then there are the...

[Solved]: If Cheri buys a zero coupon bond at \( \$ 5000 \) If Cheri buys a zero coupon bond at \( \$ 5000 \) and the face value amount is stated as \( \$ 10,000 \), how much will she receive when the bond mat... | solutionspile.com dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 Zero-coupon bond - Wikipedia WebA zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero … 1. Consider a zero-coupon bond with a $1,000 face value and 15... Answered step-by-step. 1. Consider a zero-coupon bond with a $1,000 face value and 15... 1. Consider a zero-coupon bond with a $1,000 face value and 15 years to maturity. The price will this bond trade if the YTM is 7.3 % is closest to: 2. What is the yield to maturity of a one-year, risk-free, zero-coupon bond with a $10,000 face value and a ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. What Is a Zero-Coupon Bond? - Investopedia WebMay 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Solved a. If a zero-coupon bond with a face value of $1,000 | Chegg.com a. If a zero-coupon bond with a face value of $1,000 payable in 1 year sells for $925, what is the interest rate, rounded to one decimal place? % b. If another bond with the same face value and maturity sells for $900, what is the interest rate on this bond, rounded to one decimal place? % c. Which bond, the one discussed in question a or ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Web= $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount …

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face ...

Solved Find the face value of the zero-coupon bond. 15-year | Chegg.com Transcribed image text: Find the face value of the zero-coupon bond. 15-year bond at 3.3%; price $3000 The face value will be $. (Do not round until the final answer. Then round to the nearest dollar as needed.) A six-month $4800 treasury bill sold for $4562. What was the simple annual discount rate? The discount rate was %.

42 a zero coupon bond with a face value of 1000 is A zero coupon bond with a face value of $1,000 is issued with an initial price of $212.56. The bond matures in 25 years. What is the implicit interest, in dollars, for the first year of the bond's life? A. $12.72 B. $13.58 C. $13.90 D. $15.63 E. $15.89 Implicit interest = $226.14 - $212.56 = $13.58

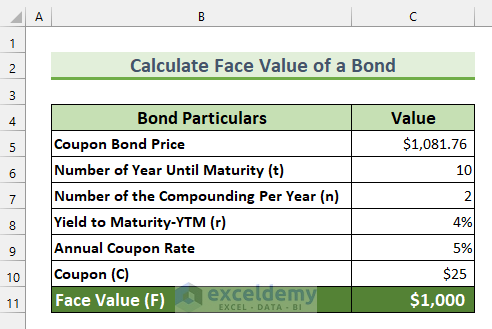

What Is the Face Value of a Bond? - SmartAsset WebSep 21, 2022 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Answered: A zero coupon bond with a face value of… | bartleby Solution for A zero coupon bond with a face value of $21,000 matures in 11 years. What should the bond be sold for now if its rate of return is to be 4.114%…

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping WebJul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

Solved A zero-coupon bond with face value $1,000 and | Chegg.com A zero-coupon bond with face value $1,000 and maturity of five years sells for $752.22. a. What is its yield to maturity? (Round your answer to 2 decimal places.) Yield to maturity % b. What will the yield to maturity be if the price falls to $736? (Round your answer to 2 decimal places.) Yield to maturity.

Zero Coupon Bond Calculator – What is the Market Value? WebP: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Coupon (finance) - Wikipedia WebIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 …

› bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

Zero Coupon Bond Definition and Example | Investing Answers Let's say you wanted to purchase a zero-coupon bond that has a $1,000 face value, with a maturity date three years from now. You've determined you want to earn 5% per year on the investment. Using the formula above you might be willing to pay: $1,000 / (1+0.025)^6 = $862.30

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

Zero-Coupon Bonds: Characteristics and Calculation Example WebTo calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) – 1; Interest Rate Risks and “Phantom Income” Taxes

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ...

› knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Calculation Example To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) – 1; Interest Rate Risks and “Phantom Income” Taxes

› zerocouponregularbondCoupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity.

› terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Solved 1. a.) A zero-coupon bond has a face value of $120.00 - Chegg A zero-coupon bond has a face value of $120.00 and matures in 3 years. The rate of return on equally risky assets is 5% (.05). What will its price be today? Suppose you sell it next year when the rate of return on equally risky assets is 4% (.04). What rate of return did you earn holding the asset for a year? b.) A stock is expected to pay an ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 zero coupon bond face value"